Overview

The Queensland Government may use debt or investments to help it deliver future initiatives and meet its liabilities. This in turn supports public sector entities to provide a wide range of services to Queenslanders. Effective debt management is necessary to ensure continued access to long-term investments and to support investment decisions.

Tabled 16 April 2025.

Report on a page

This report examines how the Queensland Government is managing its debt and investments, and reports on some recent transactions. It also discusses risks associated with the debt and investments and how government entities manage them.

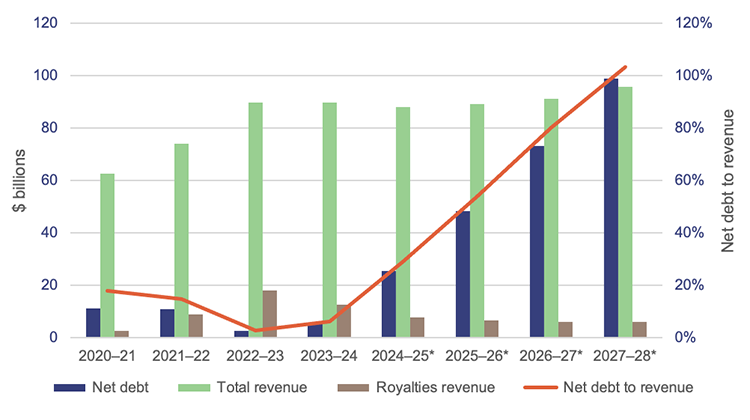

Borrowings for major projects are expected to increase

In 2023–24, net debt increased because the government borrowed more for capital projects. The increase in net debt was partly offset by increases in the value of the government’s investments.

The former government budgeted $107 billion for the state’s 4 year capital program to 2027–28, to deliver a variety of infrastructure projects. In the government’s Mid-year fiscal and economic review, this figure increased to $130 billion as it incorporated identified cost escalations.

Temporary increases in royalties revenue has contributed to managing debt but it is expected that net debt will increase over the coming years to support the capital program.

Green bonds are supporting environmental projects

Queensland Treasury Corporation (QTC) borrows money on behalf of the state government by issuing financial instruments such as bonds. Among these are green bonds, the proceeds of which are used to fund assets and projects that contribute to the management of climate change in Queensland.

QTC has identified $18.6 billion of these assets and projects. As of 30 June 2024, QTC had $12.5 billion of green bonds on issue, a net increase of $2 billion from the previous year. Using green bonds is one of the strategies and goals included in the Queensland sustainability report 2024, issued by Queensland Treasury. The Queensland sustainability report 2024 provides information on the government's approach to managing sustainability risks.

The value of government investments has grown

The government invests mainly to fund future financial obligations, such as superannuation, and to meet other policy objectives. There has been an increase in the fair value of investments in 2023–24, which is the price at which they can be sold. While the government withdrew funds for projects such as renewable energy, there were still strong investment returns contributing to a growth in value.

The government is investing in quantum computing

In April 2024, the Queensland and Australian government’s announced a joint investment of approximately $940 million ($470 million each) in American technology company PsiQuantum Corp and its Australian subsidiary. This is a significant investment for the government into a developing technology. This company is working to build the world's first utility-scale fault tolerant quantum computer that has potential in terms of advances in medicine, business, the economy, and national security.

Through this investment, the state government will support PsiQuantum to establish a quantum computer in Brisbane.

Quantum computers are still in the early stages of development and are not yet proven at a commercial level. This increases the risk around this investment.

1. Entities involved in managing debt and investments

This report examines how the Queensland Government manages its debt and investments, including the associated risks.

Fiscal refers to government spending, revenues, and/or debt.

The following entities are most directly involved:

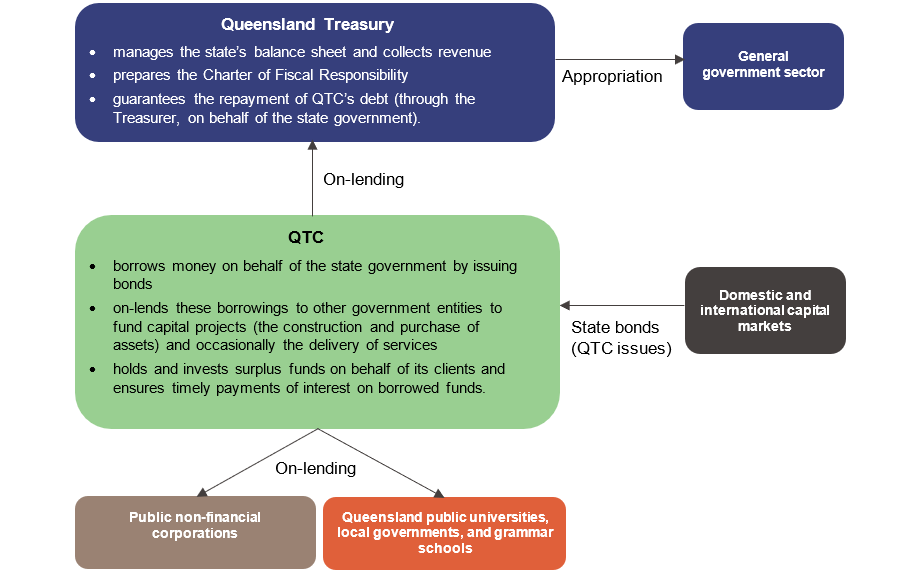

- Queensland Treasury manages the state's finances. It collects most of the state's revenue, prepares the fiscal principles for approval by government, and manages the state's budget.

Queensland Treasury Corporation (QTC) is the central financing authority for the Queensland Government. It provides financial services such as borrowings, short term investments, and foreign exchange.

Queensland Treasury advises QTC on how much the state needs to borrow. QTC then identifies the most appropriate way to raise these funds in both domestic and international capital markets. This includes buying and selling financial securities such as bonds. Once it has raised the necessary funds, it on‑lends them to certain public sector entities. We explain later in this report about how funds from debt raising are provided to government entities.

The State Investment Advisory Board (SIAB) is the advisory board of QTC, and it has both Queensland Treasury and independent representatives. It determines the investment objectives, strategies, and policies of QIC funds relating to the state’s long-term assets. This is discussed in Chapter 3.

- QIC Limited (QIC) is an investment manager and advisor for public sector entities (and others). Entities within the general government sector, as well as public financial corporations and public non-financial corporations invest with QIC.

Government entities mainly borrow to fund investment in physical assets (for example, the construction of infrastructure) and at certain times, may also borrow to pay for operating expenditure. They mainly invest money to meet obligations (for example, those relating to superannuation and insurance). These entities fit within the 3 sectors of the Queensland Government shown in Figure 1A.

Note: The orange outlines show the non-financial public sector, which is a consolidation of the general government sector and the public non-financial corporations sector.

Compiled by the Queensland Audit Office.

2. The Queensland Government’s debt position

The Queensland Government borrows money mainly to fund capital investment in infrastructure, such as schools, hospitals, and dams.

It needs to effectively manage its debt to:

- attract both domestic and international investors

- manage interest costs

- manage costs of providing significant projects or services across several years. Effective management of debt repayment time frames impacts less on the economy in the short term and spreads costs over multiple generations (all of whom will likely benefit from the spending).

This chapter analyses the Queensland Government’s net debt, including who holds the borrowings, and how the government measures and manages net debt. One of the fiscal principles of government is to manage the general government sector net debt to revenue ratio at sustainable levels in the medium term. It also aims to target reductions in the net debt to revenue ratio in the long term.

As of 30 June 2024, the state non-financial sector’s total borrowings were $139.1 billion (30 June 2023: $132.2 billion), and its net debt was $24.8 billion (30 June 2023: $24.3 billion).

Most borrowings by Queensland Treasury Corporation (QTC) are monies received from issuing bonds, a type of loan given to organisations such as companies or governments. The borrower agrees to repay the monies loaned to them, along with interest. Other types of borrowings include leases over physical assets such as office buildings; and contracts to protect against movements in interest rates, electricity prices, and foreign currency exchange rates.

Net debt is calculated as:

financial liabilities – which include deposits held, advances received, borrowings with QTC, leases and other loans, and securities

minus

- financial assets – which include cash and deposits, advances paid, loans paid, and investments.

Why does the Queensland Government borrow money?

Queensland Treasury, as part of its fiscal management role within the state, identifies and manages how to:

- fund ongoing operating (day-to-day) expenses

- fund capital expenditure (money spent to purchase or construct new assets or improve the performance of existing assets)

- manage timing of expenditure to provide for sustainable spending of monies across generations.

The state uses the revenue it generates to fund operating and capital expenditure. Usually, revenues are insufficient to fund capital expenditure completely, and the state will borrow the shortfall. There are also times when it will borrow to fund its day-to-day activities, particularly if revenues are not enough to cover these costs.

Who holds debt within the Queensland Government?

Queensland Treasury identifies the borrowing requirements for the state through the budget process. Queensland Treasury Corporation (QTC) facilitates the raising of debt by issuing bonds to both domestic and international investors.

QTC then lends money to Queensland Treasury or other government entities. Queensland Treasury uses the amounts it borrows to fund government programs or projects for entities in the general government sector and public non-financial corporations sectors, alongside other sources like taxation and royalties. Queensland Treasury transfers funds to these entities through appropriations, and recognises the borrowings from QTC on its balance sheet.

QTC also provides these services to public sector entities that are not within Queensland Government (such as universities and local governments) and to entities within the public non-financial corporations sector, who identify their own borrowing needs.

We have outlined the roles of Queensland Treasury and QTC in Figure 2A.

Compiled by the Queensland Audit Office.

What borrowings do entities hold with the Queensland Treasury Corporation?

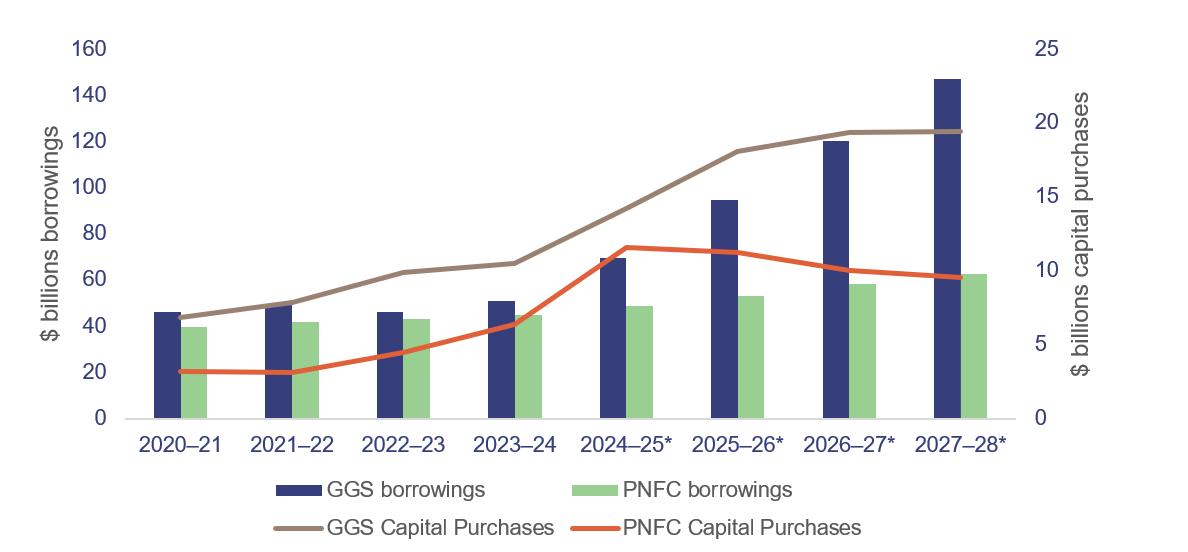

Figure 2B shows the amounts owed to QTC as of 30 June and capital purchases each year for the general government sector and public non-financial corporations sector for 2020–21 to 2023–24. It also shows projected borrowings and capital purchases for these 2 sectors to 2027–28.

As of 30 June 2024, these 2 sectors represent 89 per cent of the amounts QTC on-lends. The remaining 11 per cent mainly relates to borrowings held by public universities and local governments.

Notes: Years marked with an asterisk are projected figures, from the 2024–25 Mid-year fiscal and economic review. The above figure does not include debt that QTC holds directly to support liquidity for the state, as that is held with QTC and not on-lent to the state until it is needed.

GGS – general government sector; PNFC – public non-financial corporations sector.

Compiled by the Queensland Audit Office from Reports on State Finances and the 2024–25 Mid-year fiscal and economic review.

Most general government sector entities receive much of their funding from appropriations. Queensland Treasury borrows money from QTC on their behalf.

As shown in Figure 2B, borrowings with QTC are forecast to increase over the forward estimates (the next 4 years). The government estimated in the 2024–25 Mid-year fiscal and economic review (2024–25 MYFER) that GGS borrowing will increase to $154 billion by 2027–28 and the 4-year capital program is projected to cost $130 billion between 2024–25 and 2027–28.

In the public non-financial corporation sector, entities with income-generating energy, water, and rail assets, are the main borrowers. Total borrowings in this sector are forecast to increase over the forward estimates to fund energy and water projects under its capital program.

In the 2024–25 MYFER, the government estimated that public non-financial sector borrowing will be $64 billion.

What has caused movements in the net debt position in recent years?

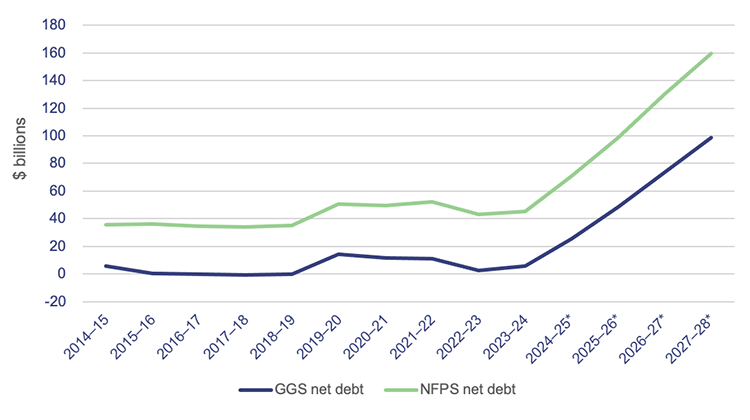

Figure 2C shows the net debt for the general government sector and the non-financial public sector since the 2014–15 financial year and projected net debt.

Notes: Years marked with an asterisk are projected figures, from the 2024–25 Mid-year fiscal and economic review.

GGS – general government sector; NFPS – non-financial public sector, which includes the general government sector and the public non-financial corporations sector. (These are the only figures available.)

Compiled by the Queensland Audit Office from Report on State Finances and the 2024–25 Mid-year fiscal and economic review.

Queensland had stable net debt from 2014–15 to 2018–19. Net debt levels increased in 2019–20 and then stabilised from 2021–22. This was due to factors such as increased revenues from coal royalties and other activities of government such as establishing the Queensland Future Fund in 2020–2021.

Net debt is projected to increase significantly over the next forward estimates to $159 billion in 2027–28, mainly due to the size of the proposed capital program.

When net debt increases, it results in higher interest and principal repayments for the government to manage. This can mean the government has fewer options available for it to manage costs of projects and services across many years. This may lead to issues such as less funding available to deliver all services the community wants, and potentially a lower credit rating.

How does the Queensland Government measure its performance in managing debt?

The state budget is focused on the general government sector. As part of the budget-setting process, the government outlines its fiscal objectives, and the fiscal principles that support them. This is included in its Charter of Fiscal Responsibility. The state budget is developed in line with these principles each year.

The government assesses the sustainability of its debt by comparing the level of net debt to the revenue it earns each year. This is referred to as the ‘net debt to revenue ratio’, and it is expressed as a percentage. A lower ratio indicates that debt can be more easily paid from annual revenues.

One of the fiscal principles is that the general government sector net debt to revenue ratio is maintained at sustainable levels in the medium term (usually between 4 and 10 years). It also aims to reduce the net debt to revenue ratio in the long term. Sustainable is not formally defined by the government, but is generally focused on debt levels at which the government can service and refinance its debt. This is based on its future projections of revenues and costs (including those beyond the forward estimates). A reduction in revenue in 2024–25 will possibly lead to an increase in net debt, compared to previous years.

While royalty revenue may have helped fund expenditure in recent years, coal prices are expected to normalise over the forward estimates and the state will have more of a reliance on borrowings.

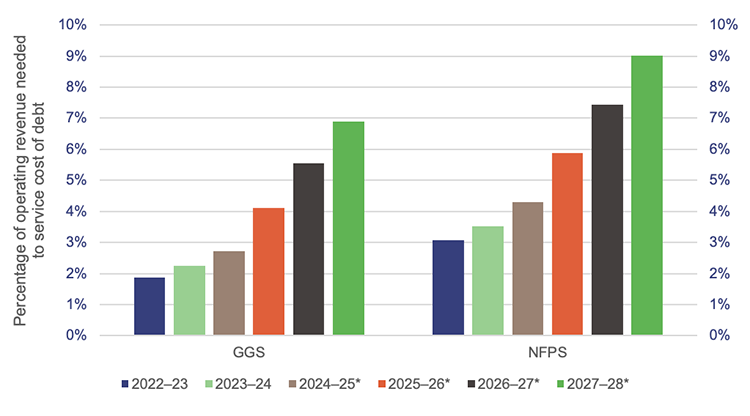

Notes: Years marked with an asterisk are projected figures, from the 2024–25 Mid-year fiscal and economic review.

Compiled by the Queensland Audit Office, from Queensland Treasury information.

Strategies may be established to achieve fiscal principles, including:

- manage the state's operating expenditure to ensure there are sufficient funds available to pay down existing debt and reduce the need to fund new projects through borrowings

- increase revenue to reduce future borrowing requirements, which may include introducing new or changed levies and taxes. The introduction of tiers for revenue from royalties (which we explain further in Chapter 4) is a recent example

- manage the state's capital purchases to ensure projects are delivered when needed and on budget.

There may be alternatives to borrowing from QTC for capital projects, such as using Public Private Partnerships (PPPs). PPPs involve a partnership between the government and the private sector to deliver public infrastructure and services, such as the Cross River Rail tunnel. Some PPPs are like a lease between the private sector partner and the state, which will see the government make regular payments to the private sector partner for making the infrastructure and services available for use by the public. However, this will still result in increased debt on the state’s balance sheet.

Other PPPs can involve the private sector partner constructing and operating an asset (such as a toll road) in exchange for charging the public fees for use or access. Such an arrangement could involve a capital grant contribution by the state.

How is interest on debt managed?

The majority of debt is borrowed by QTC and on-lent to Queensland Treasury. It is mainly held under fixed rather than variable interest rates and as a result the impact of interest rate variations in the short term is usually not significant. As new borrowing arrangements are entered, interest is paid at current market rates on new and re-financed borrowings.

The 2024–25 MYFER estimates non-financial public sector interest expenses to be $4.3 billion in 2024–25. Most of this relates to the general government sector, which has estimated interest expenses of $2.4 billion.

Comparing interest expenses to operating revenue shows what percentage of revenue must be used to service debts. Figure 2E shows that this ratio is projected to increase over the forward estimates.

The general government sector used 2.3 per cent of its operating revenue to service the cost of debt in 2023–24. This is expected to increase to 7 per cent over the forward estimates. The non-financial public sector, which includes the general government sector, used 3.5 per cent of its operating revenue to service the cost of debt in 2023–24; and this is forecast to grow to 9 per cent by 2027–28.

QTC and Queensland Treasury use several strategies to manage the risks around interest expenses. These include having a mixture of loan durations and types, and holding high-quality assets to back the debt. This includes assets such as term deposits, and government and corporate bonds.

Where appropriate, QTC also uses interest rate swaps, which allow a variable interest rate to be swapped to a fixed interest rate and vice versa.

Queensland Treasury provides input into managing the risk of variation in interest rates by:

- setting policies

- providing the framework for the approval of borrowings

- providing interest expense forecasts (based on QTC rates) to inform budgets and plans.

3. The Queensland Government’s investments

The Queensland Government holds investments to help fund long-term obligations and support future expenditure. This chapter discusses the Queensland Government’s investments, including:

- how it manages them

- the entities involved with the investments

- how the investments have performed.

How does the government manage its investments?

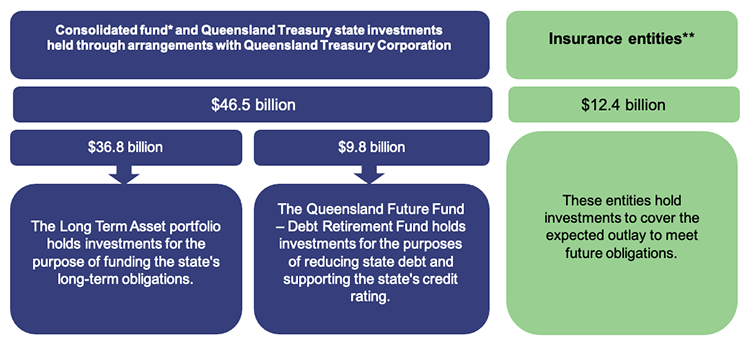

The Queensland Government holds investments across several entities, as shown in Figure 3A. It does this to:

- fund long-term obligations

- manage the state’s finances

- manage the risk associated with future payments.

Future payments, such as those arising from insurance claims against the state, are uncertain in their timing and value. Investments, and returns on investments, can help to pay for these obligations when they arise.

Figure 3A shows the significant holders of government investments, as of 30 June 2024.

Notes: *Consolidated fund is the Queensland Government’s central bank account.

**Insurance entities include Motor Accident Insurance Commission; Nominal Defendant; Queensland Building and Construction Commission; National Injury Insurance Agency, Queensland; and WorkCover Queensland.

Compiled by the Queensland Audit Office from 2023–24 Queensland Treasury Corporation financial statements and 2023–24 financial statements of the insurance entities.

Many of these investments are held through managed funds.

What is a fund?

When making announcements about various initiatives, the government will often refer to the creation of a fund, or to the contribution of money to a fund. These are usually allocations of resources or monies within budgets. They are different from managed funds.

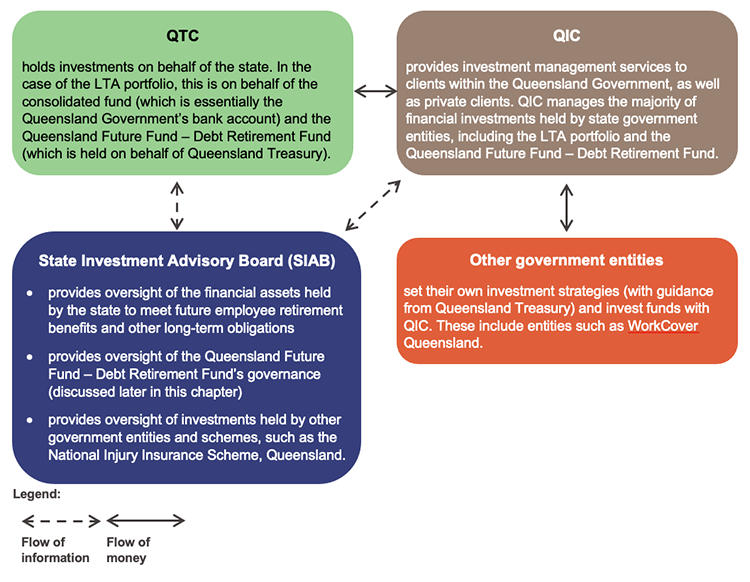

Managed funds are pools of investments held for one or more investor. For example, Queensland’s Long Term Asset (LTA) portfolio is part of a managed fund held by Queensland Treasury Corporation (QTC) and invested by QIC Limited (QIC).

The state’s portfolio of investments is held by various government entities.

QIC is the investment manager of the state’s long-term investments and manages them on a day‑to‑day basis.

The State Investment Advisory Board (SIAB) provides oversight for the investment strategies for the government’s managed funds. It is the advisory board of Queensland Treasury Corporation (QTC), and it has both Queensland Treasury and independent members. It determines the investment objectives, strategies, and policies of QIC funds relating to significant state investments.

Figure 3B outlines the roles and responsibilities of the key parties involved in managing the state’s investments.

Compiled by the Queensland Audit Office.

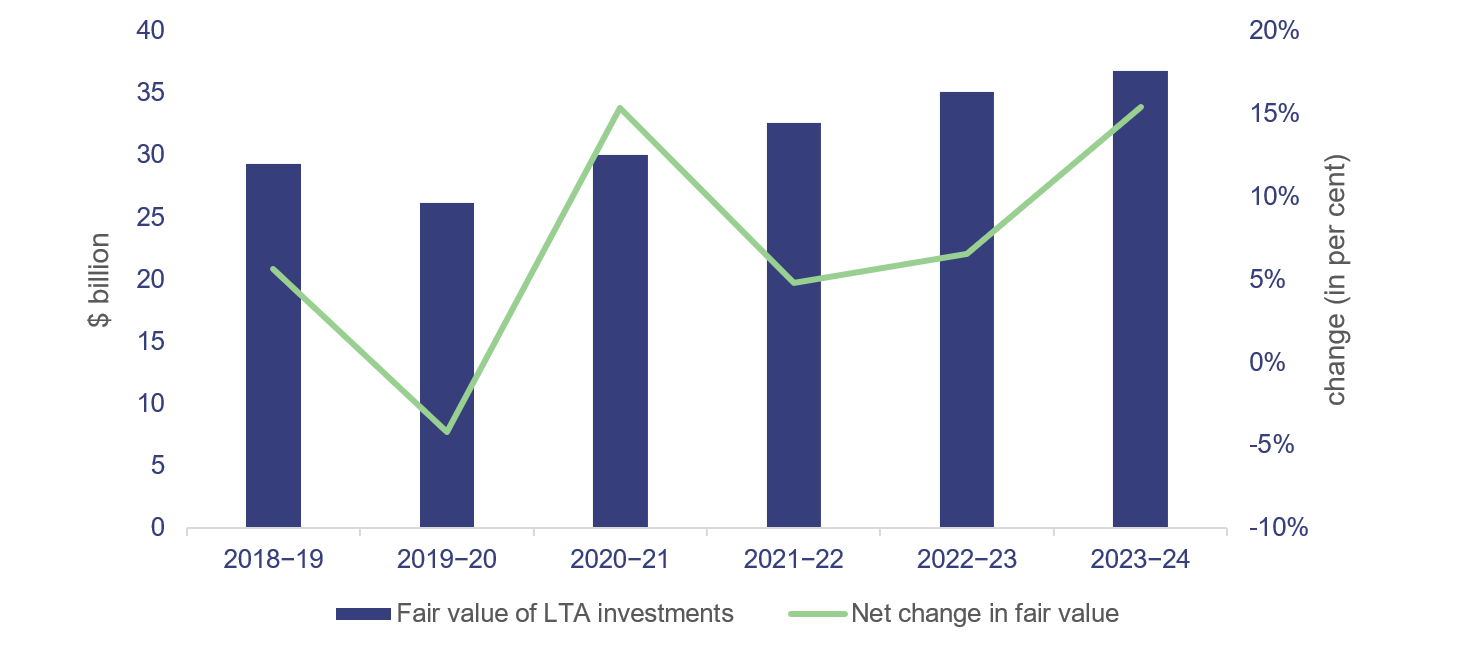

How have the investments performed?

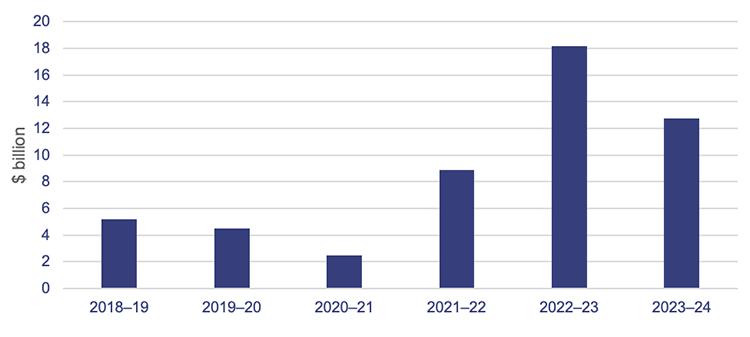

The Long Term Asset (LTA) portfolio is the largest single asset pool held within the state, and it has a mix of different types of investments, known as a ‘diversified asset mix’. It is mainly held for the purpose of funding long-term obligations of the state. Figure 3C shows its total assets in recent years, compared to the change in fair value of these assets. Fair value is the price at which the investments could be bought or sold.

Notes: Net change in fair value represents only the movement in the fair value of investments each year, it does not include deposits or withdrawals made during the year. The fair value of Long Term Asset investments represents the total value of the investment at each year end which includes the movement in fair value, deposits, and/or withdrawals made during the year.

Compiled by the Queensland Audit Office.

Figure 3C shows there have been significant fluctuations in the change in fair value of investments over the past 6 years. In 2021–22 and 2022–23, there were lower returns compared to 2020–21. These were due to the global economic impacts of COVID-19 and other geopolitical factors, such as the war in Ukraine.

The value of the LTA portfolio has steadily increased from 2019–20 to 2023–24. This is due to positive returns and deposits into the portfolio. In 2023–24, the fair value of the assets increased by $5.7 billion due to strong returns on the investments, offset by net withdrawals of $4 billion. Net withdrawals include all withdrawals included in the bullet points below, as well as the state’s share of defined benefit payments, Queensland Government Insurance Fund claims, management fees charged, and less deposits into the portfolio. The withdrawals included:

- $1.3 billion used as an investment into government-owned electricity businesses for renewable energy projects. These investments were established to support the Queensland Renewable Energy and Hydrogen Jobs Fund. This fund was established to expand public ownership of renewable energy and hydrogen projects

- $411 million, which was transferred from the LTA portfolio into a separate state-owned investment portfolio. Overall, there was no change in the total investments held by the state.

In addition, funds were withdrawn from the Housing Investment Fund ($329 million), Carbon Reduction Investment Fund ($85 million), and Path To Treaty Investment Fund ($49 million) to cover program funding provided through the appropriation process to departments between 2021–22 to 2023–24.

Defined benefit superannuation scheme

The largest liability the LTA portfolio supports is the defined benefit superannuation scheme. The scheme provides benefits that are calculated based on several factors, including each member’s salary at retirement and number of years of service. Benefits for the scheme members are protected from movements in the market.

The Queensland Government holds the defined benefit superannuation obligation for the State Public Sector Superannuation Scheme and the Judges’ Scheme. These schemes provide for post-retirement benefits to certain public service employees and have been closed to new members since November 2008.

The scheme is recorded in the whole-of-government financial statements, in accordance with the Australian Accounting Standards Board’s accounting standard AASB 119 Employee Benefits.

The calculation is complex, and it is performed by actuaries who assess and measure financial risk. They use assumptions about future salary growth, interest rates, and inflation when estimating the value to be paid in future.

The government has a fiscal principle related to long-term obligations such as the defined benefit superannuation scheme, which aims to have the financial obligation fully supported by investments. This is based on actuarial advice to ensure that the required funding is in place to meet future liabilities.

The actuary uses different criteria to assess if the superannuation liability is fully funded under actuarial standards than those required by the applicable accounting standards. This can result in a significant difference in the surplus/deficit calculated under accounting and actuarial standards. The fiscal principle is based on the actuarial criteria, not accounting (which is used to present figures in the financial statements of the government).

Actuarial reviews are required to be completed at least once every 3 years and the most recent actuarial review completed for the year ended 30 June 2024 concluded that the LTA assets held to meet defined benefit obligations exceed accrued liabilities by $9.9 billion.

The Queensland Future Fund

The Queensland Future Fund was established to support Queensland’s credit rating and reduce debt. It provides a framework under which investment funds may be created. One fund has been created under this framework – the Debt Retirement Fund (the fund). This section provides information on the fund’s performance for the year ended 30 June 2024, and on the investments held within the fund.

Queensland Treasury Corporation (QTC) and Queensland Treasury report on the performance of the fund in their annual reports. QTC reports on the financial assets in the fund held with QIC, and reports on the financial liability for the fixed rate note held between QTC and Queensland Treasury. Queensland Treasury discloses a financial asset in its financial statements for the fixed rate note.

A fixed rate note is a debt instrument that pays a fixed amount of interest per annum. It is used to recognise the benefit of an investment for one party, even though the investments themselves are held by another party.

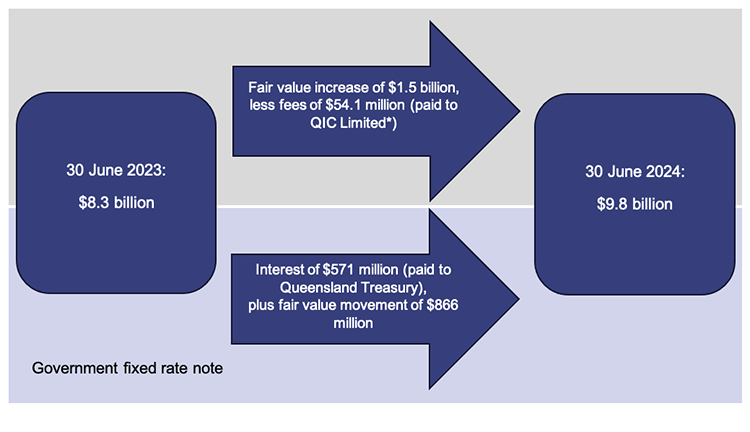

Figure 3D provides a summary of the Debt Retirement Fund’s financial performance and movement in value.

Notes: Fair value is the price at which the investments could be bought or sold. The movement reflects the change in fair value over the financial year.

*QIC returns a portion of the fees it receives to Queensland Treasury as part of the Competitive Neutrality Fee Regime. (This requires public sector entities to pay taxes to remove the benefits that result from their public ownership when they are competing with the private sector.)

Compiled by the Queensland Audit Office.

The fair value movement indicates positive investment returns.

Parts of the fund are reported on in multiple sets of financial statements, including:

- the Debt Retirement Trust (the trust), which is managed by QIC. It is reported on in special purpose financial statements, which are not available publicly. The trust had a return of 15 per cent for 2023–24 (2022–23: 8 per cent)

- the investment in the trust, which is held by QTC. This is reported as a financial asset by QTC and reflects the return of 15 per cent, excluding fees paid

- a fixed rate note between QTC and Queensland Treasury within the Queensland Treasury financial statements. This note reflects the value of the trust at the start and end of each financial year.

Figure 3E summarises some of the main objectives of the Queensland Future Fund, as outlined in the 2021–22 Queensland Budget, and assesses progress against them.

| Budget objective | Assessment of progress |

|---|---|

| Provide for debt reduction | As of 30 June 2024, no payments have been made from the Queensland Future Fund to reduce the state’s borrowings. The value of the fund offsets the state’s debt for the purposes of calculating net debt. |

| Hold state investments for future growth | The assets in the fund are diversified across a range of asset classes, in accordance with the investment strategy set by the State Investment Advisory Board. The investments experienced positive growth in 2023–24, as outlined in Figure 3D. |

| Offset state debt to support Queensland’s credit rating | At the most recent review of the credit rating in 2024, Moody’s and Fitch (credit rating agencies) affirmed the state’s and QTC’s credit ratings, with a stable outlook. Following the release of the 2024–25 Mid-year fiscal and economic review (2024–25 MYFER) by the government in January 2025, S&P Global (one of the ratings agencies) identified factors that could negatively impact the rating. As of February 2025, while no downgrade of the credit rating has occurred, S&P Global revised their outlook on the state of Queensland from stable to negative. |

Note: We have excluded one objective from Figure 3E as it has been fully achieved. The objective was to provide a contribution of $7.7 billion to the fund as at 30 June 2021.

Compiled by the Queensland Audit Office.

Queensland’s credit rating

Queensland has an investment-grade credit rating. ‘Investment-grade’ bonds are seen as higher-quality investments than lower-rated ‘speculative-grade’ bonds. This credit rating allows the state to access capital at more affordable interest rates. It also gives easier access to funds from the international bond market and helps to secure foreign direct investment.

The most recent assessments of Queensland’s credit rating by the rating agencies are as follows:

- S&P Global: AA+ (outlook negative)

- Moody’s Ratings: Aa1 (outlook stable)

- Fitch: AA+ (outlook stable).

There has been no change to the state’s credit ratings from last financial year, however S&P Global announced in February 2025 that they have revised the outlook from stable to negative.

A rating outlook is an indication of the direction for a long-term credit rating over the shorter term (generally 6 to 24 months). A negative outlook means that a credit rating may be lowered. If the S&P Global rating were lowered to AA, the rating would still suggest a very strong capacity to meet financial commitments.

If the state’s credit rating is downgraded, it may lead to higher interest rates. This means the state will face higher borrowing costs, as lenders will demand more in return for the increased risk that the debt may not be repaid. Additionally, a downgrade could reduce investor confidence, causing them to reconsider investing in the state due to higher perceived risk.

Supporting Queensland’s credit rating

Payments from the Debt Retirement Fund can only be used to either pay down the state’s debt or reinvest in the fund, and pay for the costs of managing the investments.

For the year ended 30 June 2024, the Debt Retirement Fund reinvested its returns in other investment funds. The increase in the value of the fund during 2023–24 was $1.5 billion as shown in Figure 3D, resulting in a total reduction of net debt by $9.8 billion.

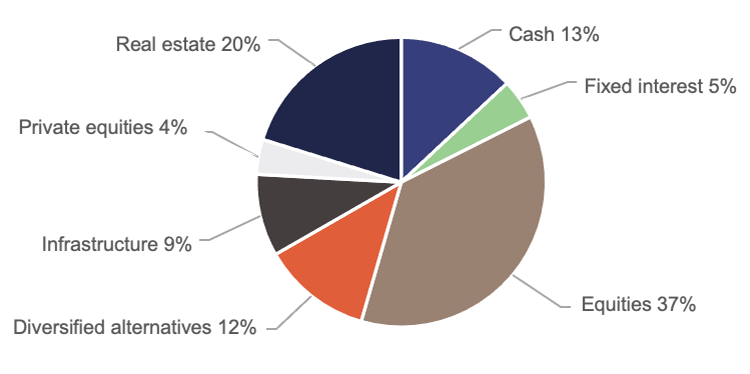

The Debt Retirement Fund is invested across multiple asset classes, as shown in Figure 3F. The investment mix is similar to what it was in 2022–23.

Notes: Equities – investments in Australian and overseas shares.

Diversified alternatives – investment in varied pools of investments across alternative asset classes, such as private equities, infrastructure, and properties.

Private equities – investments in private companies (those that are not listed on a stock exchange).

Compiled by the Queensland Audit Office.

4. The Queensland Government’s significant transactions

In managing the finances of the state, the government will enter into transactions and implement strategies to manage revenues, expenses, and investment for Queensland. All of these have impacts on its budget and forward estimates. In 2023–24, the government continued to receive additional royalties revenue from coal prices remaining above the long-term average. Royalties are what companies pay, for example, to mine coal. Through QTC, it also issued green bonds that will provide additional investment into initiatives in Queensland to help manage the effects of climate change.

In addition, the government announced an investment into quantum computing through PsiQuantum, in conjunction with the Australian Government.

Queensland’s royalties revenue

The 2022–23 Queensland Budget introduced 3 new coal royalties ‘tiers’ from 1 July 2022. The tiers were structured to increase royalty income when the average sale price of coal went up. As the revenue earned by mining companies increased, they had to pay more in royalties to the state.

The increased coal prices and the coal royalties tiers led to a temporary surge in the royalties revenue collected by the state in 2021–22, 2022–23, and 2023–24.

Coal prices decreased in 2023–24 compared to the previous year, resulting in a decline in royalty revenue received by the state. Assuming coal prices normalise in line with long-term trends, revenue from royalties is expected to continue to decline.

Compiled by the Queensland Audit Office.

In the 2022–23 Budget Update, the state government outlined that $4 billion of the additional royalties revenue would be used to fund a range of investments across regional Queensland. This included funding for infrastructure projects (such as the pumped hydro projects), hospitals, and cost-of-living support (such as energy rebates).

Financing Queensland’s environmental and sustainability projects through green bonds

Queensland Treasury Corporation (QTC) borrows money on behalf of the state government by issuing bonds. QTC issues several different types of bonds to attract different types of investors. One type is known as a green bond. Other states and territories also use green and sustainability programs, or a mix of both, to raise money. As of 30 June 2024, QTC has issued $12.5 billion through its green bond program, the largest amount of any state. The second largest issuer in Australia was New South Wales, who issued $7.3 billion of sustainability bonds and $4.7 billion of green bonds. There are some differences between the bonds that each state issues. This includes whether they are certified as well as how and when the money is used for specific projects.

Green bonds are used to finance or re-finance specific projects that are aligned with international environmental and sustainability frameworks. They must also support Queensland’s environmental and sustainability objectives.

QTC has identified several state government projects that are eligible for financing under the Green Bond Principles issued by The International Capital Market Association and Climate Bonds standard. QTC publishes its Green Bond Annual Report each year, in which it lists the eligible projects and reports on their environmental or social impact.

A green bond is any type of bond instrument that finances projects aligning with the 4 core components of the Green Bond Principles. The 4 components are:

- Use of proceeds: proceeds should be exclusively used to finance or refinance green projects.

- Process for project evaluation and selection: the issuer should communicate how the green projects meet environmental criteria, how projects are selected, and how it manages relevant risks.

- Management of proceeds: the issuer should track how green bond proceeds have been allocated, and it should have formal internal processes in place relating to the management of the green project.

- Reporting: the issuer should report annually on its allocation of proceeds to green projects and provide brief descriptions of the projects and their expected impact.

QTC issues green bonds to attract investors who want to invest in projects that are aligned with environmental or sustainability objectives. They may also support access to additional investor groups who may not otherwise be interested in investing in Queensland.

The green bond program helps ensure QTC can continue to access competitive sources of funding both locally and overseas.

QTC has independently verified its green bond framework, eligible projects, and annual report to an international certification scheme. This allows them to label the bonds Climate Bonds Initiative Certified. The certification is intended to provide investors with assurance that their investment will fund projects with a positive environmental or sustainability impact.

Queensland Government’s investment in quantum computing

In October 2023, the Queensland Government launched its Queensland Quantum and Advanced Technologies Strategy. This strategy, with $76 million of funding attached, aims to support development of several areas of quantum research and innovation. This includes quantum computing. The Australian Government released its National Quantum Strategy in May 2023.

On 30 April 2024, the Australian and Queensland governments announced an investment of approximately $470 million each ($940 million total) into PsiQuantum Corp (PsiQuantum). This investment is for it to build and operate a fault tolerant quantum computer (FTQC) facility in Brisbane, where it would also base its Asia-Pacific headquarters.

This article is intended to outline the structure of the Queensland Government's investment in PsiQuantum. We have not audited the procurement process or the application of any of the investment structuring decisions outlined below. We have compiled the below based on our discussions with government entities and review of documentation. We have not provided any assurance to parliament or entities on the PsiQuantum investment process or the proposed benefits.

Benefits and risks of quantum computing

Quantum computers are different from traditional computers, using sub-atomic particles to solve certain complex types of problems faster than traditional computers. The processing power of a quantum computer is much greater than a traditional computer, meaning it can consider multiple angles and instances of a problem at once, improving problem solving outcomes. There are still complex technology and operational development areas to resolve.

They are expected to provide solutions to issues of high economic and strategic value. For example, it may allow scientists to model chemical interactions in contexts such as drug design and carbon capture, using specialised new materials, and may support security tools such as encryption. There is expected value in the fields of security, medicine, artificial intelligence, telecommunications, manufacturing, energy, and climate and financial modelling.

Utility-scale viable quantum computers are not yet available and early access may provide security, economic, and strategic advantages.

While there are many expected benefits relating to quantum computing, it also comes with significant risks. These risks include issues like cyber security threats, ethical concerns, and potential geo-political threats. It is important to manage these challenges as the technology develops. The future of quantum computing is also dependent on appropriate regulation and ethical considerations.

Queensland Government’s investment in PsiQuantum

PsiQuantum is an American-based company focused on building the FTQC. The FTQC will need access to power and other utilities, as well as land to house the computer and other supporting infrastructure. PsiQuantum’s FTQC will be located within the Brisbane Airport precinct.

PsiQuantum is privately owned and has used fundraising to support its research into building its commercial FTQC. Several private companies invested in PsiQuantum in fundraising rounds prior to the Australian and Queensland Government’s investment.

Discussions and negotiations on building the FTQC in Australia commenced between PsiQuantum, Queensland, and other state governments in early 2022.

Prior to the investment, the federal and state governments undertook financial, commercial, and legal due diligence to investigate the investment opportunities and risks. The majority of the due diligence work was undertaken separately by each government. We have not assessed or audited the due diligence processes undertaken.

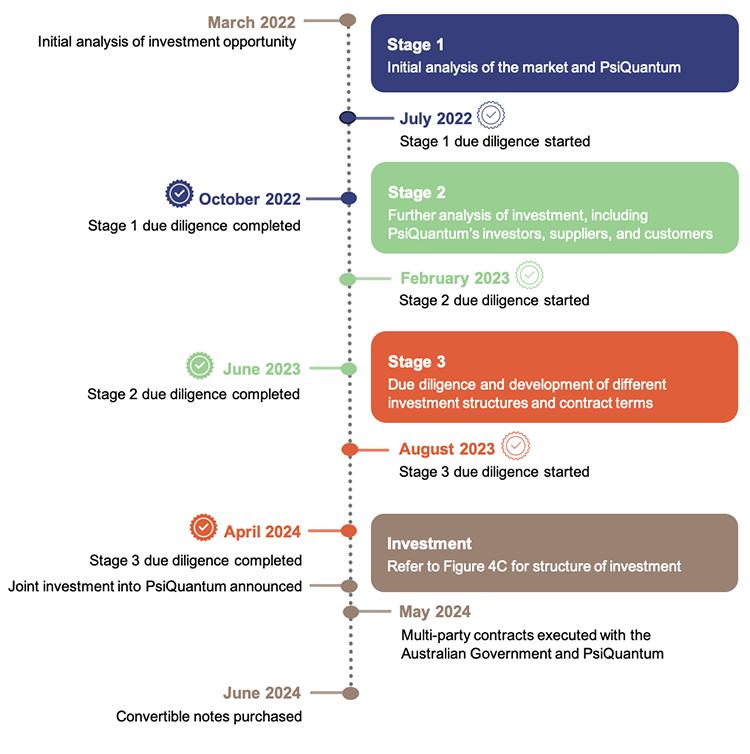

The Queensland Government, including Queensland Treasury and QIC Limited (QIC) undertook 3 stages of due diligence:

- The first stage, completed in October 2022, focused on an initial analysis of the investment opportunity, the quantum computing market, and PsiQuantum’s financial position and prospects.

The second stage was completed in June 2023. It focused on a more detailed analysis of the investment opportunity, including

- technology

- PsiQuantam’s business plan

- economics

- other investors into PsiQuantum

- partners and suppliers already working with PsiQuantum

- current and potential customers

Technical experts and previous private investors into PsiQuantum provided input at this stage. The analysis also quantified the benefits to Queensland based on a range of scenarios, if the FTQC was successfully built in Queensland.

- The third phase was completed in April 2024. This phase was conducted by QIC, which the government appointed as the investment manager. QIC engaged technical experts across several areas. It explored the types of investment structures that could be used to manage risks and increase benefits to the state. It also accessed legal expertise so it could understand what might be needed in contracts to manage risks and track benefits.

The investment was announced on 30 April 2024. Contracts between parties were signed on 31 May 2024.

Figure 4B provides an outline of the timeline for the investment from the Queensland Government’s perspective:

Compiled by the Queensland Audit Office.

Convertible notes are a debt investment that can be converted into shares once a certain milestone is met. This provides the state government some eventual ownership of the company. Before that, this type of investment manages risk, because the government is considered to be a ‘higher-priority debt holder’. This puts it above those with equity (ownership of assets), which rank lower than debt if a company is liquidated. While a convertible note is still classed as debt, security (for example, assets) is held to allow for recovery of the investment, if there is a default.

A conditional loan facility is a type of loan agreement where the borrower can only receive the loan if certain conditions are met. These conditions can include, for example, achieving a specific milestone.

A conditional grant funding facility is an agreement to provide funds. The funds will be granted and will not need to be repaid as long as certain conditions are met. If these conditions are not met, the facility will need to be repaid.

Structure of the investment

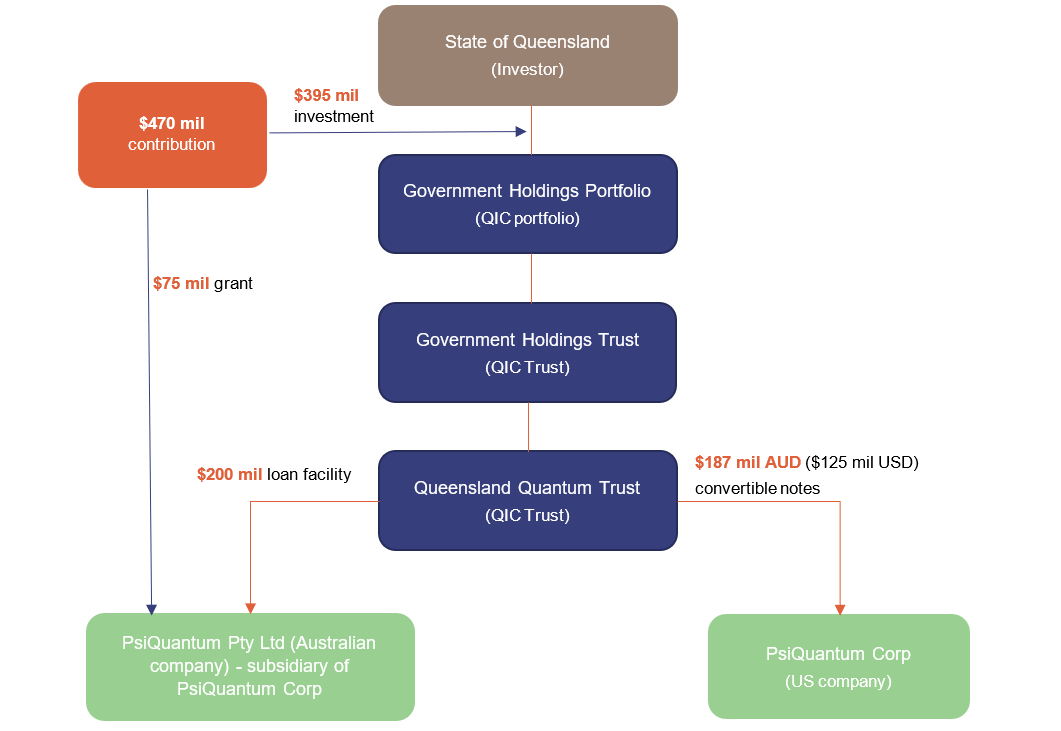

The state’s investment in PsiQuantum is held by QIC in the Government Holdings Portfolio (GHP) as shown in Figure 4C. A new QIC trust called the Queensland Quantum Trust (QQT) has been created to house the PsiQuantum investment within the GHP. The investment is disclosed as part of investments managed by QIC Limited in the securities and shares note in the Report on State Finances. Similar to other investments in the Report on State Finances, it is not disclosed separately in the financial statements.

The Queensland and Australian governments both agreed to invest approximately $470 million each into PsiQuantum. The Queensland Government's investment was structured into 3 components:

- convertible notes in PsiQuantum Corp. The convertible notes were valued at $188 million as at 30 June 2024

- a conditional loan facility of $200 million. This project financing will support the construction of the FTQC in Queensland. The loan will have security (assets being held as collateral for a loan if the loan cannot be repaid) over the FTQC components as well as over income received for the commercialisation of technology being developed. As at 30 June 2024, the loan funds had not been used

- a conditional grant funding facility of $75 million. It will not be required to be repaid when PsiQuantum delivers on its economic commitments, and it will become a grant. If economic commitments are not delivered, the grant needs to be repaid with penalty rates. As of 30 June 2024, the funds had not been used.

PsiQuantum will need to meet certain conditions including project and technical milestones, project finance, supply chain developments, and job creation, prior to funding payments being made for the construction of the computer and facility. No payments will be made for the operation of the FTQC.

Within the contract, it was agreed that independent verification of claims was required prior to payments being made. The independent technical experts have been jointly appointed by the Queensland and Australian governments.

If the FTQC is successful, the government expects to make a financial return from the repayment of loans, interest, establishment of a local quantum computing facility, and shareholder returns. If it is unsuccessful, the maximum potential financial exposure is $470 million, however this could be reduced through measures such as the security package under the investment.

Figure 4C outlines the investment structure and amounts as of 30 June 2024.

The amounts on this figure differ from the total value of $470 million reported elsewhere due to foreign exchange differences and GST.

Compiled by the Queensland Audit Office from Investment Management Agreement between the state and QIC and the 2023-24 Government Holdings Trust financial statements.

Next steps

Construction of the new facility will begin in early 2025, subject to planning, development, and environmental approvals for the development site.

The Queensland Audit Office will audit key controls in place within the government entities managing the investment in PsiQuantum. The key controls we plan to focus on are those used to monitor and track the investment in PsiQuantum, and the progress against the expected benefits included in key agreements. We will report on the outcomes of our work as part of the Managing Queensland’s debt and investments 2025 report to parliament.